However it's not always a good concept. If something goes wrong, you risk losing your home. And if you wish to pass your house to your partner or children when you pass away, a reverse home mortgage could put this plan at risk. Here are a couple of concerns you must ask yourself to identify if a reverse home loan is the best service to your monetary difficulties.

When you get a reverse home mortgage, you don't have to pay anything back for as long as you're living mainly in the house and you can keep up with the property taxes, insurance, and other required costs. If you choose to move somewhere else for your retirement, or if you transfer to an assisted-living facility, the balance comes due, even if you don't sell the home at that time - what is the current interest rate for home mortgages.

Your heirs still can seize your home, but they need to either pay off the balance of the reverse mortgage or receive a standard home loan on the home instead. If they don't want to keep your house themselves, they can constantly sell it and put the profits toward the loan.

If your home sells for more than the balance of the loan, your heirs will inherit the difference. If it sells for less than what you owe, your mortgage insurance coverage will cover it. Since of these threats, it's generally not a wise relocate to get a reverse home loan if you mean to leave the home to someone after you pass away.

If both you and your partner are aged 62 or older, you can put both your names on the reverse home loan. That suggests if among you dies, the other will continue getting payments and will not need to pay anything back till they pass away or leave. But things get harder if your partner is younger than 62 or if you have other individuals living in the house.

Rumored Buzz on Why Are Most Personal Loans Much Smaller Than Mortgages And Home Equity Loans?

And there will not be anything you or anybody else can do about it unless you pay off the balance of the loan. The one exception to this is non-borrowing spouses. If your partner is not of age to certify as a co-borrower on the reverse home mortgage, they can still be noted as a non-borrowing partner.

Nevertheless, due to the fact that they're not the debtor on the reverse home mortgage, they will not be able to gather any more money from it. If you deal with others, you should talk refinance timeshare through your choices with them to decide if a reverse home mortgage is the very best decision for your family. And if your spouse is close to turning 62, it may be worth waiting a bit so that they can be listed as a co-borrower.

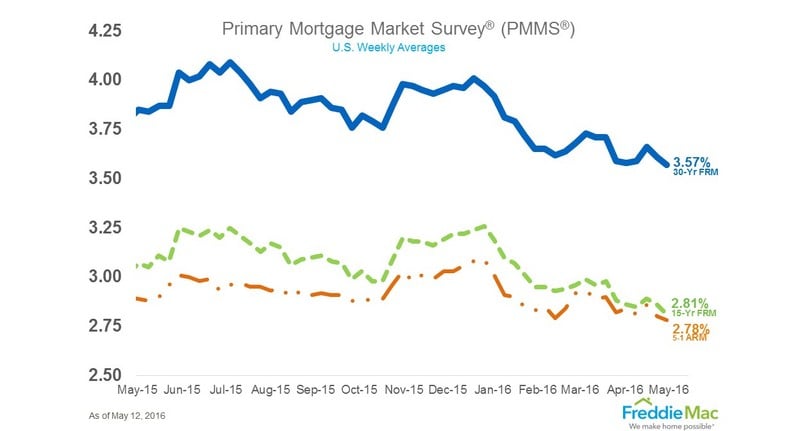

There are a great deal of up-front costs, including loan origination costs, mortgage insurance coverage, and closing costs. Nevertheless, your lending institution may allow some of these to be rolled into the cost of the home loan so you do not have to pay them out of pocket. The loan will accrue interest at a rate that often goes beyond traditional home loan rate of interest.

If you reverse and offer your house in the next couple of years, you'll get less out of it, since you'll need to pay what you owe the bank first. If you expect moving, or if you fear you might end up with a medical condition that requires you to relocate to an assisted living home, then a reverse mortgage isn't right for you.

When you get a reverse home mortgage, you must pay mortgage insurance, which safeguards the lender in case you can't pay back what you borrow. This is normally somewhere in between 0. what is the current interest rate for home mortgages. 5% and 2. 5% of the value of your house in advance, plus a continuous premium that you must pay regular monthly timeshare weeks calendar 2016 after that.

The smart Trick of What Is The Current Index For Adjustable Rate Mortgages That Nobody is Discussing

If you fall back on any of these payments, your lending institution is within its legal rights to call the balance of the reverse home mortgage due. In that case, you should pay up, or the bank will foreclose upon the home. Prior to you make an application for a reverse home loan, it is necessary to compute just how much you can expect to pay in home mortgage insurance coverage, home taxes, and house maintenance.

If you don't feel that you'll have the ability to spend for these expenses, a reverse home loan isn't right for you. If you have actually decided that a reverse mortgage isn't the very best choice for you, there still are other methods you can get the cash you need. Consider selling your house and downsizing or renting.

It's a good concept to consider all of your alternatives before making a relocation. While a reverse home mortgage can be the best choice in select circumstances, many people are better off searching for alternative ways to bring in cash that do not require them risking the roofing system over their heads.

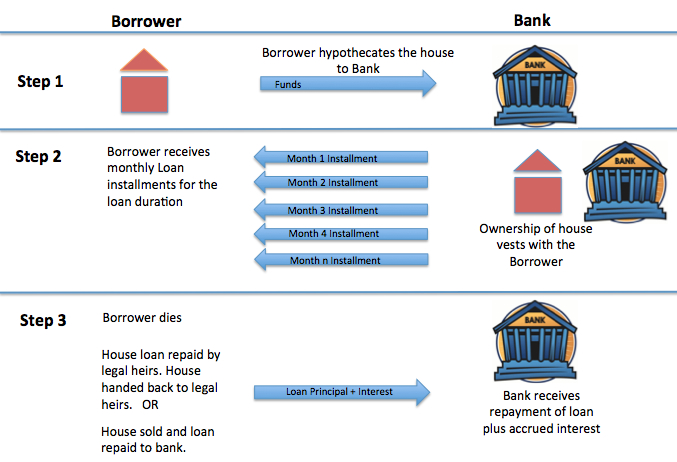

A reverse home mortgage is a mortgage made by a mortgage lending institution to a house owner utilizing the house as security or collateral. Which is considerably different than with a conventional home mortgage, where the homeowner utilizes their earnings to pay for the debt with time. However, with a reverse home mortgage, the loan amount (loan balance) grows gradually due to the fact that the property owner is not making month-to-month mortgage payments.

The quantity of equity you can access with a reverse home mortgage is identified by the age of the youngest customer, current rates of interest, and value of the house in concern. Please keep in mind that you might need to reserve extra funds from the loan continues to spend for taxes and insurance.

Getting My What Are Basis Points In Mortgages To Work

They wish to redesign their kitchen. They have heard about reverse home mortgage loans but didn't know the information. They decide to call a reverse mortgage advisor to discuss their present needs and future objectives if they might get access to a portion of the funds kept in their home's equity. what are the different types of home mortgages.

They presently owe $35,000 on their home mortgage. Below is an illustration of how John and Anne spend their loan earnings. * This example is based upon Anne, the youngest customer who is 69 years of ages, a variable rate HECM loan with a preliminary rates of interest of 2. 495% (which includes an adjustable rate of 0.

375%). It is based on an evaluated worth of $400,000, origination charges of $6,000, a home mortgage insurance coverage premium of $8,000, other settlement expenses of $2,740, and a mortgage benefit of $35,000; amortized over 372 months, with overall finance charges of $16,740 wyndham timeshare reviews and a yearly portion rate of 4. 87%. Rates of interest may differ and the mentioned rate may change or not be offered at the time of loan commitment. * The funds available to the debtor may be restricted for the first 12 months after loan closing, due to HECM reverse mortgage requirements.

Details precise as of 03/28/2019. Lots of steps are included prior to a new loan being moneyed and the property owner( s) to start getting funds. We have provided to you a fast visual example of what you may prepare for when beginning the procedure of a House Equity Conversion Home Mortgage. Next steps: Take a few moments to start approximating your eligibility utilizing our totally free reverse mortgage calculator.